Back to Resources

Back to Resources

One of the most significant changes coming from the Tax Cut and Jobs Act (TCJA) is the tax treatment of businesses. Selecting an entity type is among one of the most important decisions taxpayers can make when doing business. Now, more than ever, selection and/or changing entity type can have significant implications on the tax situation of the business and/or its owners. The following entity types are selected based on a number of factors:

- Sole Proprietorships / Disregarded Entities

- Partnerships

- S Corporations (also known as pass-through entities)

- C Corporations

Changing entity classification may carry an immediate tax burden, but future tax reductions may offset the cost of conversion. Please note that it is important to speak with a tax professional before taking any action.

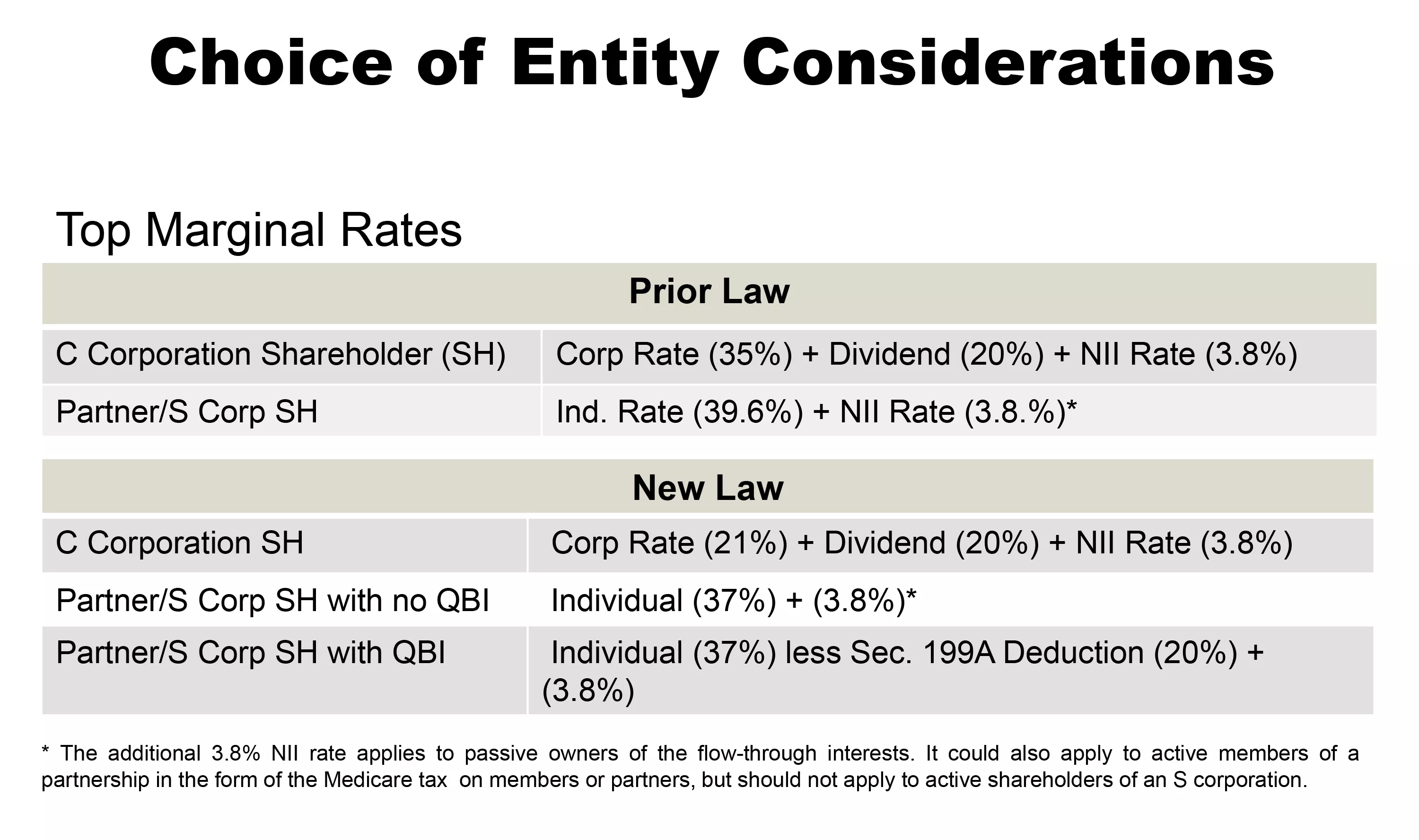

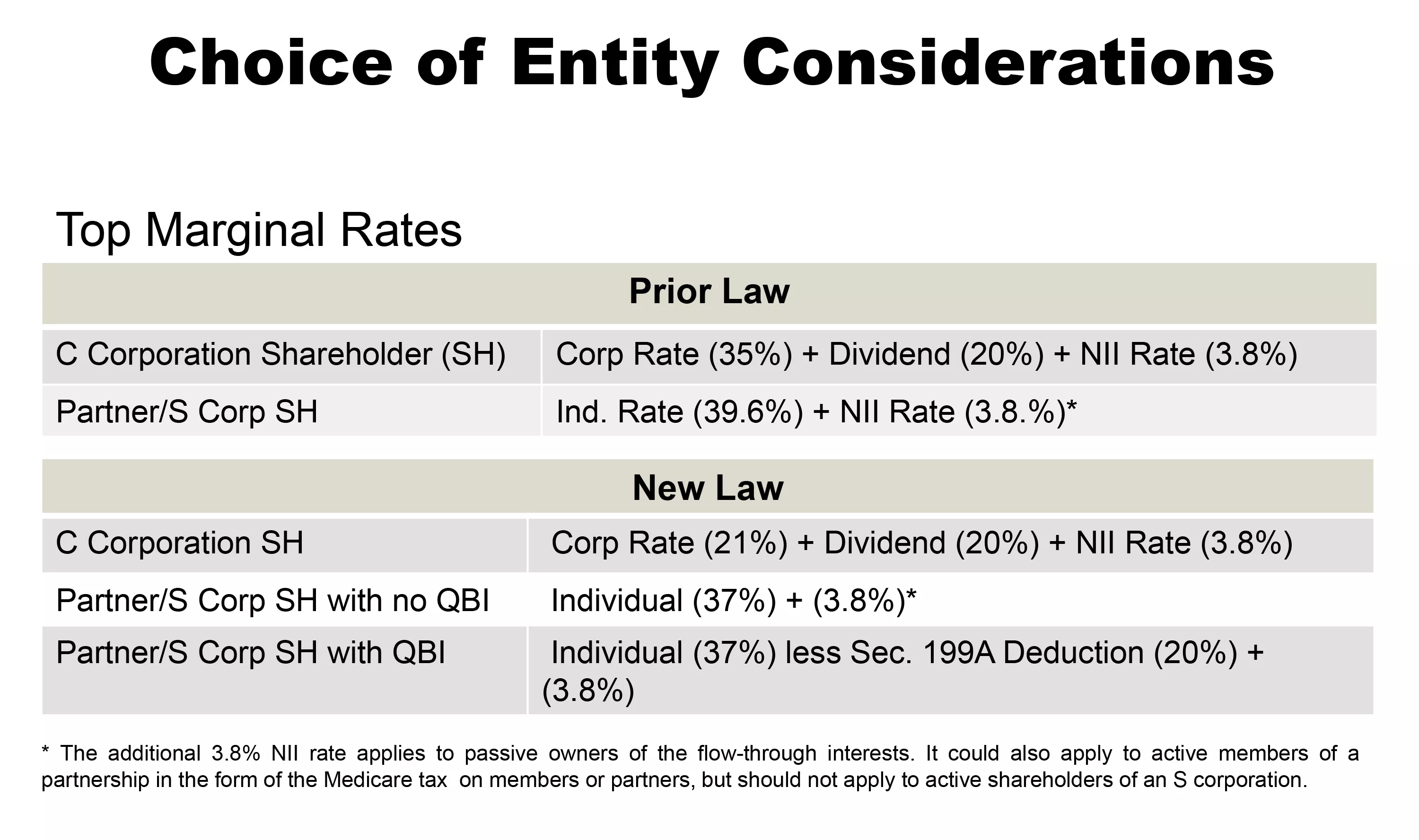

The chart below illustrates the tax rates prior to the TCJA and the rates under the new law. As shown, the corporate tax rate has been reduced from 35% to 21% and the tax imposed on dividends distributed remains the same at a rate of 20%. The Net Investment Income Rate (NII), also known as Obamacare tax, can affect both C Corporations and pass-through entities.

C Corporations

Under the TCJA, C Corporations incur a double tax. The two levels of tax include 1) tax on the income earned by the business and 2) the tax on the earnings distributed to shareholders as dividends. Individual shareholders must report this income on their individual tax returns. Keep in mind that dividends are taxed at a special dividend tax rate.

In order to avoid a double tax, C Corporations can invest earnings in areas such as mergers and acquisitions, expansion, capital improvements and re-tooling. However, there is a limit to the amount of earnings that can be accumulated and invested in non-business assets. Eventually, the IRS can impose a second (dividend) tax on the excess earnings. Please refer to the chart above to view the tax treatment for C Corporations.

S Corporations

The tax treatment of pass-through (S Corporation) entities is different under the TCJA. Pass-through entities incur one level of tax. Pass-through entity owners that meet certain conditions are eligible for a 20% deduction on their business income. Those who file jointly and earn at least $315,000 in business profits are subject to limitations on the deduction. The restriction is based on how much the pass-through pays in wages or invests in equipment and machinery. Service businesses, such as law and accounting firms, are eligible for the deduction if owners are under the threshold. The conference agreement provides that trusts and estates are eligible for the 20% deduction under the provision with limitations based on wages paid. The TCJA also includes a provision that would limit a partnership’s ability to offset passive income (dividends or interest or rental income) with losses from an active trade or business in excess of $500,000 for joint filers or $250,000 for an individual.

Is it Beneficial to Switch from an S corporation to a C Corporation?

This strategy may benefit companies looking to reinvest capital, as opposed to those that need to distribute profits in the form of taxable dividends. A single level of corporate tax at a lower rate conserves much needed cash for growing businesses, which reduces the need for bank loans and the cost of additional interest that decreases earnings. However, the longer-term opportunity cost is the loss of basis build-up in the event of a future sale of stock.

Once an S corporation election is terminated, and the entity is converted to a C corporation, there is generally a five-year waiting period to re-elect S status (certain exceptions exist, including when there is a change in ownership of the C Corporation to otherwise eligible shareholders).

Here is How the Built-in Gain Tax Works

When a C Corporation converts to an S Corporation, the company may still owe tax if assets are sold and certain built-in gains are triggered within the first five-year period after conversion. This is called the built-in-gains (BIG) tax. Switching from C to S may ultimately be a path to lower taxes and elimination of the 2x tax. However, within the first five years, a double tax may still apply if certain gains are triggered in that first year of that five-year period. For owners who are not interested in accumulating earnings to acquire businesses or expand and upgrade facilities, they may find more after tax liquidity and flexibility by switching to an S corporation.

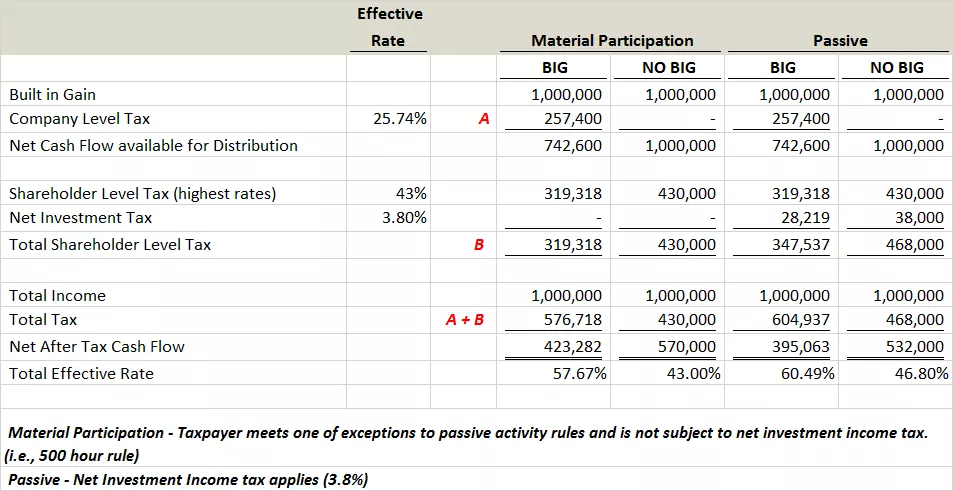

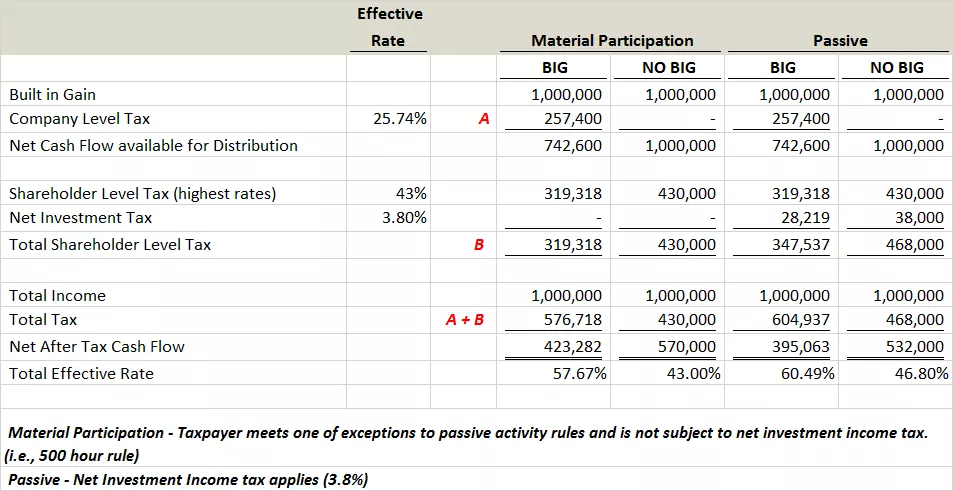

Beginning January 1, 2018, BIG rates are 21% at the federal level and 6% for Georgia, with the blended effective rate being 25.74%. This tax reduces the income that flows out to the shareholder on a K-1. The income is then taxed again at the individual level net of the tax cost at highest marginal rates based on the character of income (no pass-through deduction available as gains generally are not considered to be Qualified Business Income).

BIG tax is still a “big” issue for former C Corporations. The recognition period has been significantly reduced from 10 to five years. Companies that are considering making a change to their IRS status (a switch to S status) should review their situation with their tax advisor prior to taking any action.

The chart above is a high level example of how the BIG tax works.

What’s Next?

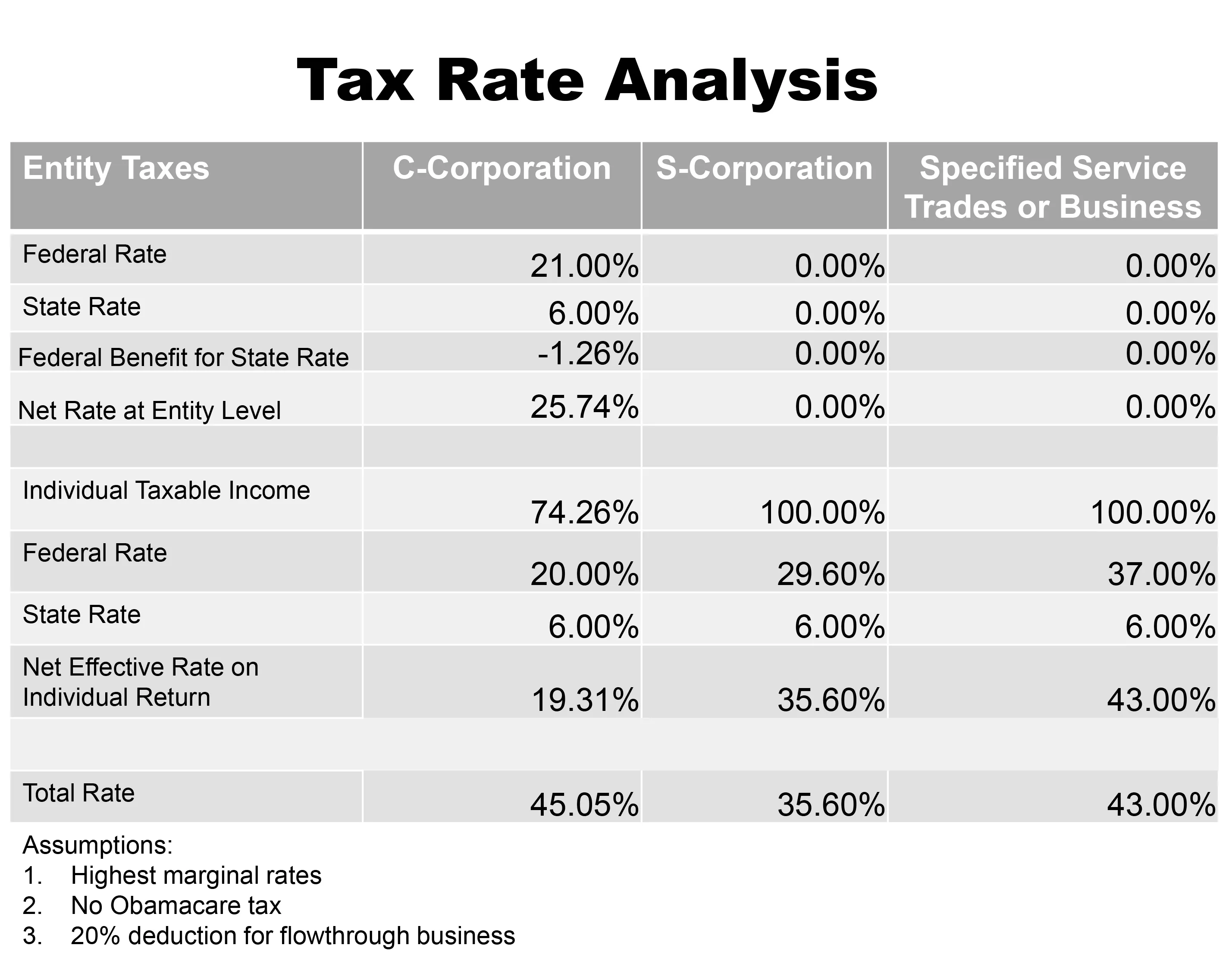

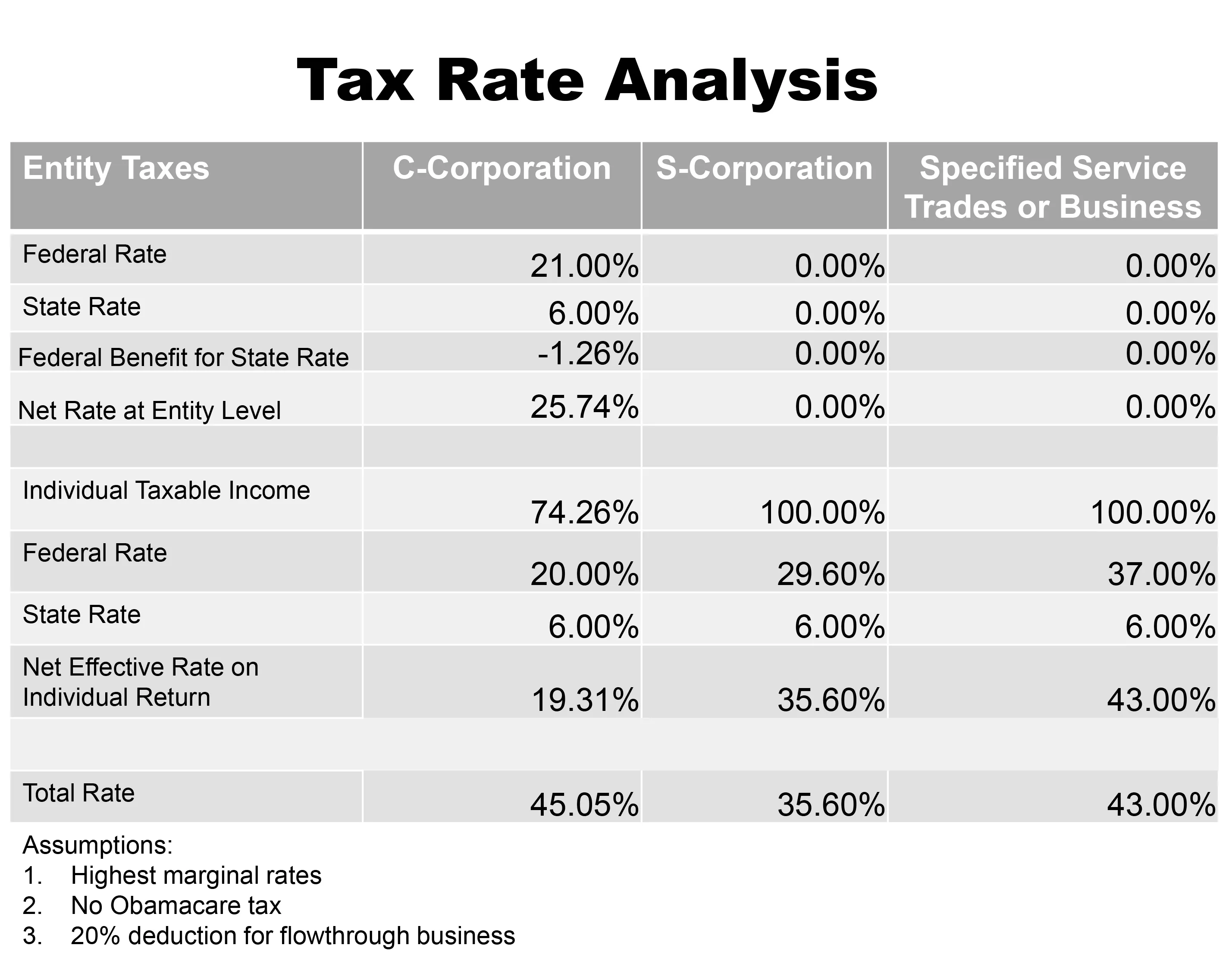

If a business is already established as a pass-through entity, rates under TCJA are still lower and there is most likely not a reason to change. It is important to speak with a tax professional to discuss the current status of your entity and determine the strategy that will benefit your company the most over the long run. For a side-by-side comparison of the tax treatment for C Corporations and S Corporations, please refer to the chart below. This tax analysis incorporates the Georgia corporate tax rate of 6%.

For questions on entity considerations and tax reform in general, please contact Mark Abrams at 404-874-6244 or fill out the contact form below.

In addition, please be on the lookout future communications from Smith and Howard’s tax group on additional details of the new tax bill.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR