Back to Resources

Back to Resources

In general, businesses have nexus in states in which they have a physical or economic presence, or both. Each state defines nexus differently, and it’s unfortunately easy for businesses to run afoul of these complex rules.

If you discover that your business is noncompliant with a state’s income tax nexus laws, know that you have options to become compliant.

This article is the third in a series exploring what business leaders need to know about correcting and proactively managing state income tax nexus matters. Read the first article here: Guide to State Income Tax Nexus. Read the second article here: State Income Tax Nexus: How to Know If You Are Compliant.

What Causes State Income Tax Nexus Issues?

A company has a state income tax nexus problem when it doesn’t file state income tax returns or pay state income taxes as state law requires.

Nexus problems often arise when a company doesn’t know where it has nexus, which can easily happen when a business rapidly expands or experiences substantial growth. Receiving notices from tax authorities in states that you haven’t filed in can indicate nexus problems, too. The best way to fix that is to have an experienced multistate tax advisor conduct a nexus study, which reveals where your business has income tax nexus and estimates how much you might owe in unpaid income tax, late filing fees, and penalties.

How Serious Are State Income Tax Nexus Issues?

Nexus issues that go unchecked for years can be expensive to resolve. That’s because there’s no statute of limitations on state tax audits when you haven’t paid state income tax or filed a state income tax return.

Put another way, if a state tax authority discovers that you have nexus and didn’t pay income taxes, it can assess unpaid state income tax, fees, and penalties for any tax year in your business’s history—even back to day one.

As you can see, it’s important to seek solutions to nexus compliance matters as soon as they’re discovered.

3 Options to Address State Income Tax Nexus Issues

It can be stressful to learn that your business has nexus in a handful of states you didn’t expect. However, there is a way to address noncompliance without opening yourself up to a no-holds-barred state income tax audit.

The best solution depends on your specific circumstances. By having an experienced tax advisor determine your potential exposure—the scope of your noncompliance—in each jurisdiction, you’ll have what you need to make an informed decision.

Enter Into a Voluntary Disclosure Agreement

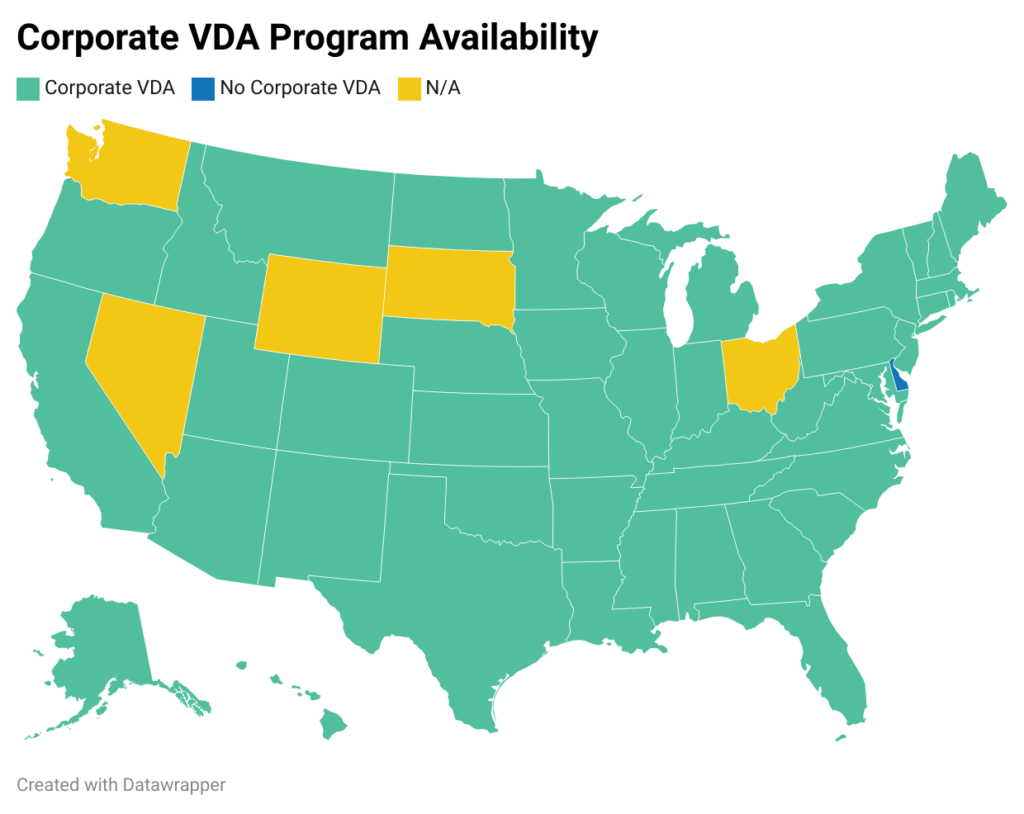

State tax authorities know they’ll never be able to catch every taxpayer that should be paying income tax. To collect revenue that it’d otherwise miss, states offer voluntary disclosure agreement (VDA) programs that provide protection to businesses that come forward to disclose their prior-year tax liabilities. Most states allow individual and corporate taxpayers to request VDAs.

VDA benefits vary by state, but here’s what you can usually expect:

- Limited lookback period: Under a VDA, a state tax authority can only examine your business’s tax liability from the last three to five years. Absent a VDA, the state can assess income taxes you might owe from any tax year.

- Waived penalties: There are financial penalties for failing to file a state income tax return and pay income state tax. VDAs often waive these often-hefty penalties.

Entering into a VDA requires some prep work. Your tax advisor will have to prepare state income tax returns for the years that cover the VDA’s lookback period before requesting a VDA from the state tax authority. The advanced preparation is necessary for two reasons:

- Requesting a VDA requires information about your tax liability that is figured when preparing your return.

- Once your VDA request is accepted, you usually have no more than 30 days to file your returns and pay the taxes owed—often not enough time to start years’ worth of tax prep from scratch.

Once the returns are prepared, your tax advisor will contact your state tax authority with anonymized information about your business and its state income tax liabilities. Once the VDA is signed, your tax advisor will file your business tax returns, and you’ll pay the state income taxes you owe. You’ll then continue to file and pay your state income taxes yearly as if you had always been compliant.

Note that VDAs aren’t available to taxpayers that have already received audit notices. It’s just one more reason it pays to be proactive on your journey to nexus compliance.

Start Filing State Income Returns and Paying State Income Tax

In some situations, you might hold off on filing prior-year returns and simply start filing state income tax returns and paying state income taxes. It might be the most cost-effective option if you owe only a small amount of prior-year income tax to a state and are willing to accept the risk of an audit.

As with any of these options, there are pros and cons to filing state tax returns prospectively. Although it’s cheaper to set aside your potential tax liability from prior years, you risk being audited and held responsible for failing to file returns and pay state income tax.

Filing a state income tax return for the first time in your company’s history can set off alarm bells for a state tax authority, potentially increasing the likelihood of an audit. Your tax advisor will caution you to consider the risks before planning to ignore your past tax filing responsibilities.

Monitor Your Exposure

Sometimes, state laws and relevant case law don’t provide enough clarity on whether your business has nexus in a state. That puts you in a tough spot: Do you file state income tax returns even if you’re not sure whether you have nexus? Your tax advisor can explain the risks so that you can determine the best course of action based on your risk tolerance.

In these situations, you might delay a decision until evidence overwhelmingly supports that you do or don’t have nexus in a state. Make sure to work with your tax firm to document your rationale behind not filing an income tax return when you potentially owe income tax to the state.

Remember that your business doesn’t need to take the same approach in every state. If your nexus study reveals you’re noncompliant in three states, you can sign VDAs in two and simply start filing in the third.

Example: Resolving State Income Tax Nexus Problems

Let’s say you have a state income tax nexus study done on your 10-year-old business. You learn that you should’ve been filing state income tax returns and paying income tax in Alabama since Year 2.

Estimates show that you should’ve paid about $150,000 in income tax, and if the state audits you and discovers your noncompliance, you’ll owe another $50,000 in penalties and fees.

Option 1: Enter Into a Voluntary Disclosure Agreement

The Alabama VDA program limits the lookback period to three years, meaning your tax advisor will prepare Alabama state income tax returns from only the past three years.

Through this process, you learn that instead of owing $150,000 in state income tax, you owe only $50,000. And instead of facing an additional $50,000 in penalties and interest, you owe $15,000 in interest only.

You’ll also be absolved of prior state income tax nexus noncompliance once the three years of returns are filed and the tax and interest due are paid.

Option 2: Start Filing State Income Returns and Paying State Income Tax

When you choose to start filing returns and paying tax prospectively, you avoid having to prepare three years’ worth of Alabama state income tax returns. Also, you end your streak of state income tax noncompliance.

However, you’re still at risk of the Alabama state tax authority catching on to your prior-year failures to file and pay state income tax. Put simply, you remain at risk of owing $150,000 in past-due tax and an additional $50,000 in penalties and interest.

Option 3: Monitor Your Exposure

If you decide neither to enter a VDA nor to start filing your state income tax returns, you could be on the hook for $200,000 from past years’ instances of noncompliance and whatever you might owe in the years to come.

What To Do If You Receive an Audit Notice for a State Income Tax Nexus Problem

Audit notices and notices of assessments related to state income tax nexus issues sometimes lead taxpayers to believe that they must pay what the state says they owe. That’s not always true.

Whenever you receive an audit notice or notice of assessment from a state tax authority, it’s critical to reach out to your tax advisor. An adept tax advisor can represent you, challenge the authority’s assessments, and negotiate penalty abatements to reduce your total liability.

Smith + Howard: Your Guide in State Income Tax Nexus Issues

Navigating state income tax nexus matters calls for a guide who’s been down the path before. Advisors at Smith + Howard have helped numerous clients resolve their state income tax nexus issues through VDAs, catch-up tax filings, and more.

Contact an advisor to start your journey to state income tax nexus compliance.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR